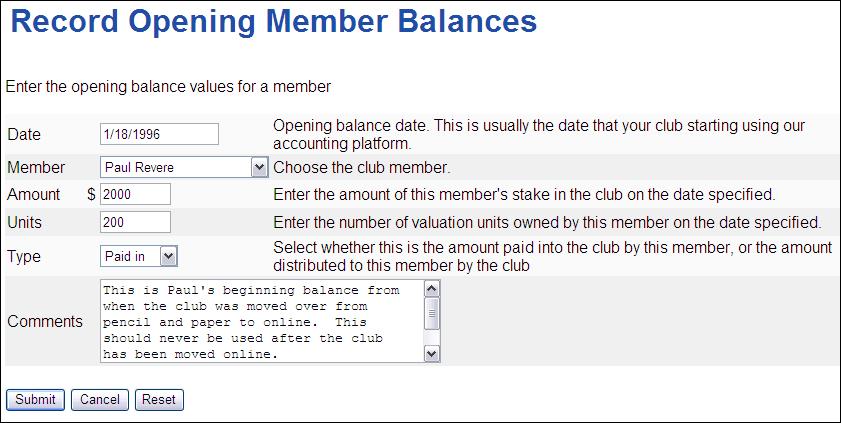

This page is designed to be used if the club is switching from doing it's book-keeping on a system other than one of ICLUB's previous accounting programs. It allows the club to enter members paid in balances and any earnings previously distributed to the member. If a member has both paid in and distributed earnings balances, enter one transaction of each type for that member. If the member does not have, or the club cannot find an earnings figure, it is also acceptable to enter just a Paid In amount, along with the member's units.

Unless otherwise directed by ICLUBcentral support, this page should ONLY beused to enter beginning balances for the members of the club on the switchover date.

Scenarios for members who have taken partial withdrawals some time before the 12/31 switchover date.

Examples:

John Hancock has paid in $3000. While a member his share ofearnings is $1000. He made a partial withdrawal of $3500.

For his Paid In Amount, enter negative500 (3000 paid in, minus 3500 withdrawn.) For his Earnings Amount, enter 1000.

The Paid in Plus Earningsfor John Hancock will now equal 500 (500 +1000).

If the value received was more than the amount paid in, plus allaccumulated earnings, subtract the amount received from thepaid in amount, the results will be a negative number, and usethe result as the Beginning Balance Investment amount. TheBeginning Balance Earnings will be the same number as theInvestment amount but positive. The sum of paid in and earningswill now be zero.

Alternate Example:

John Hancock has paid in $3000. While a member his share ofearnings is $1000. He made a partial withdrawal of $5000.

For his Paid In Amount, enter negative2000 (3000 paid in, minus 5000 withdrawn.) For hisEarnings Amount, enter 2000. The Paid in Plus Earningsfor John Hancock now equals zero (2000+2000). TheEarnings amount is changed because the sum of the paid inamount and the earnings amount should never be less thanzero.