|

Processing Club Member Withdrawals

by Douglas Gerlach

This article originally appeared in BetterInvesting Magazine.

Determining how best to pay off a member withdrawal often causes stress and strife in investment clubs. Members debate the merits of paying the departing partner in cash or by transferring shares of stock, or they argue over whether it's best to raise cash by selling stock or requiring additional member contributions.

There is an upside to withdrawals, however, in the terrific opportunity they offer for the club to clean up its portfolio. Whether selling underperformers to raise cash or transferring shares to the departing member, the club and its members can realize significant tax advantages regarding how capital gains or losses are treated נas long as the club selects the right approach for the right type of withdrawal.

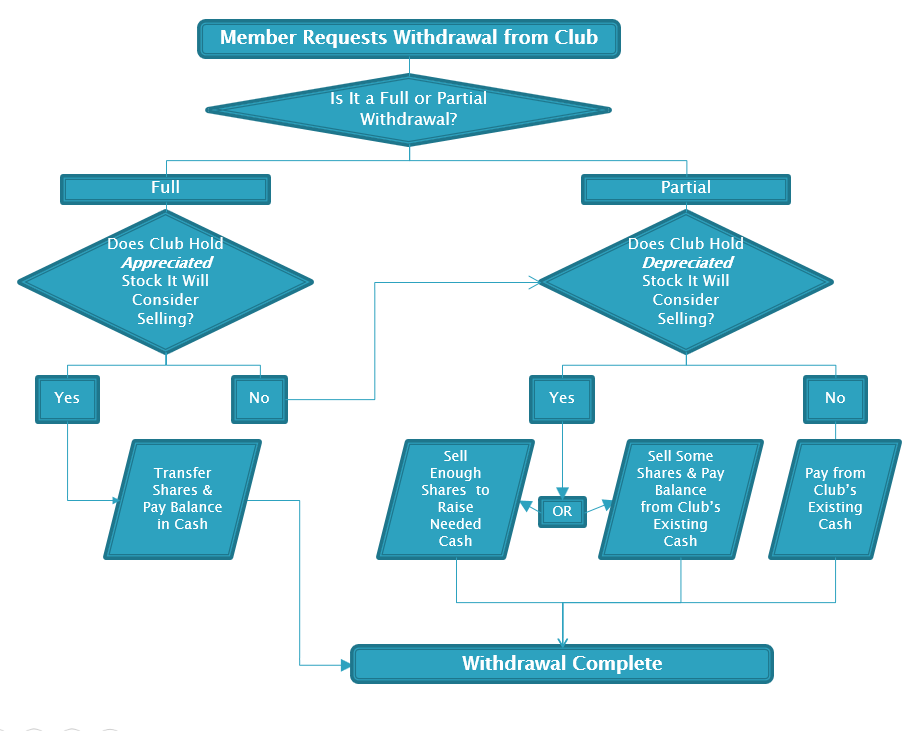

The accompanying flowchart for member withdrawal decisions is meant to assist clubs in deciding how best to process a partner withdrawal, based on whether the member is fully withdrawing from the club or is requesting only a partial withdrawal. Note: If the club has sufficient cash to take care of a withdrawal within the guidelines established in the club's operating documents, members might simply pay out the partner in cash without worrying about selling or transferring shares.

In the case of a full withdrawal, clubs can take advantage of Internal Revenue Service rules that allow for special tax treatment for transfers of appreciated property to a departing partner. If the club owns shares of stock in which large capital gains would be realized upon sale of those shares, the club can transfer some of those shares to a fully withdrawing member (and pay some additional cash to make up the balance due).

For withdrawing members, their tax basis in the partnership becomes their cost basis in the transferred shares. When withdrawing members eventually sell these shares, assuming that the sale price is above this cost basis, taxable capital gains will be generated. This is good for withdrawing club members, since they can control the timing of the sale (and thus the generation of the gains).

For the remaining club members, the capital gain from the transfer of shares is held on the club's books. When one of these remaining members retires from the club, his or her share of the gain from that transfer will be realized. It doesn't matter if the withdrawal is six weeks or 12 years later. This is why it's better to transfer appreciated shares instead of selling them in the case of a full withdrawal -- the remaining members get to defer the capital gains indefinitely, instead of realizing them in the current year and paying taxes on them.

In addition, if the club has overvalued stocks with capital gains, transferring these shares can help reduce the risk in the club portfolio (there may be a limited upside for these stocks at their current prices) and improve the portfolio's diversification.

The IRS doesn't allow this strategy to work for partial withdrawals, however. In the case of partial withdrawals, the preferred way of raising cash is to sell shares in a stock on which your club has lost money (on paper) since it was purchased. It's likely to be a company that hasn't lived up to the club's original expectations, usually due to identifiable problems that are driving down the share price. Nevertheless, the club has continued to hold this stock in the (slim) chance that the company will (hopefully someday) recover.

In selling these underperformers, the club helps to clean up its portfolio and also incurs capital losses. Selling to capture capital losses can be a smart tax tactic.

At year-end, these losses would be passed through to the club's partners, who would use them to offset capital gains or ordinary income or to carry forward to future years. As such, the club members recognize a fairly immediate tax benefit and receive the added advantage of seeing the club portfolio's overall quality increase.

Saying goodbye to a stock in this way doesn't have to be forever. If the members are so inclined, the club could repurchase shares in that same company once the club had accumulated enough cash and after completing a 30-day waiting period (to avoid running afoul of the wash sale rule, which would invalidate the capital loss). As the old saying goes, however, "once burned, twice shy." Clubs that have had a bad experience with a stock may well choose to avoid that same holding in the future.

As the flowchart suggests, clubs should not transfer appreciated stock to partially withdrawing members. The special capital gains tax treatment applies only to full withdrawals. Also, clubs should not transfer depreciated shares to fully withdrawing members, since it is far better to sell those shares and capture the capital losses for the club instead.

Another tool to help you determine the optimal method for withdrawing a member is available to users of myICLUB.com. The Withdrawal Scenario Calculator demonstrates the recommended methods for withdrawing a member for both full and partial withdrawals, and for stock and cash payouts. It's available in the Members section of the website.

Douglas is ICLUBcentral's President, helping develop the company's web tools and newsletters including myICLUB.com, the Investor Advisory Service newsletter, and the SmallCap Informer newsletter. He is also the author of several investing books, including The Pocket Idiot's Guide to Direct Stock Investing, The Complete Idiot's Guide to Online Investing, The Armchair Millionaire, and Investment Clubs for Dummies.

|